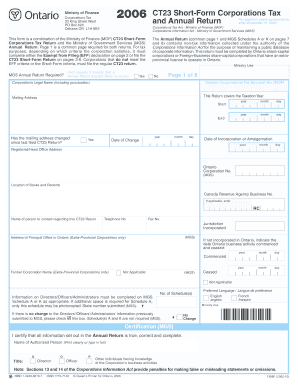

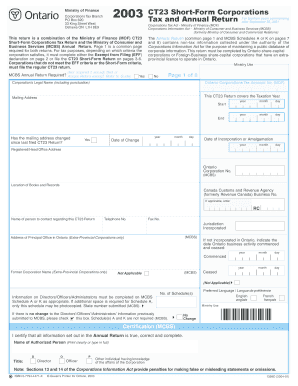

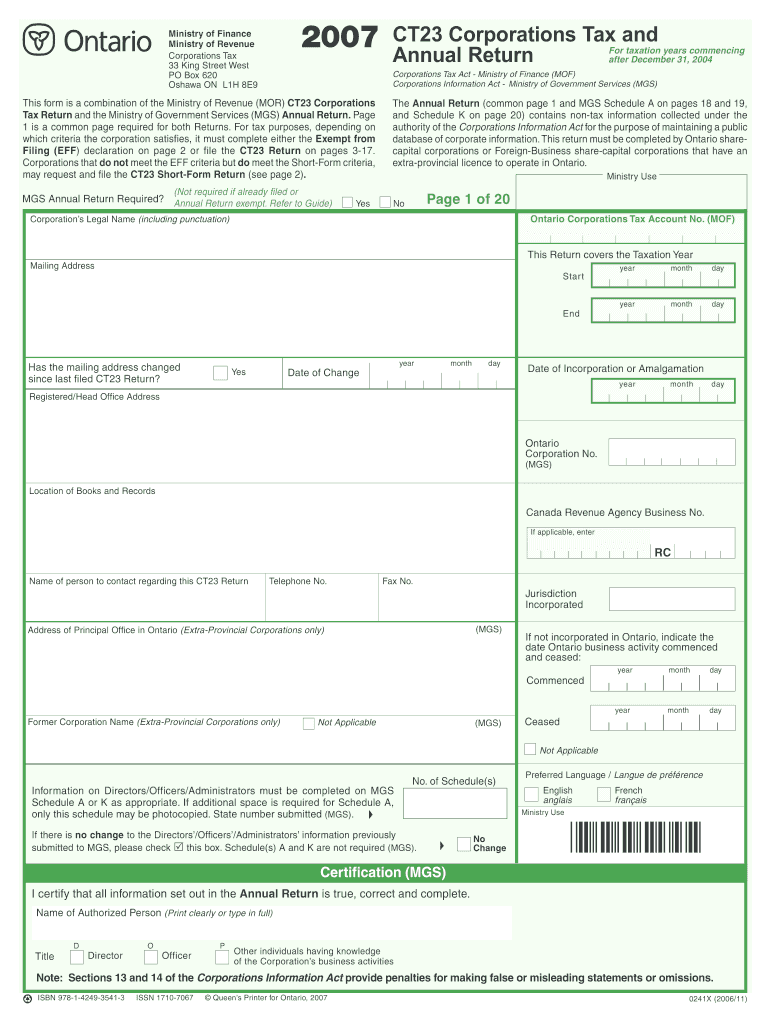

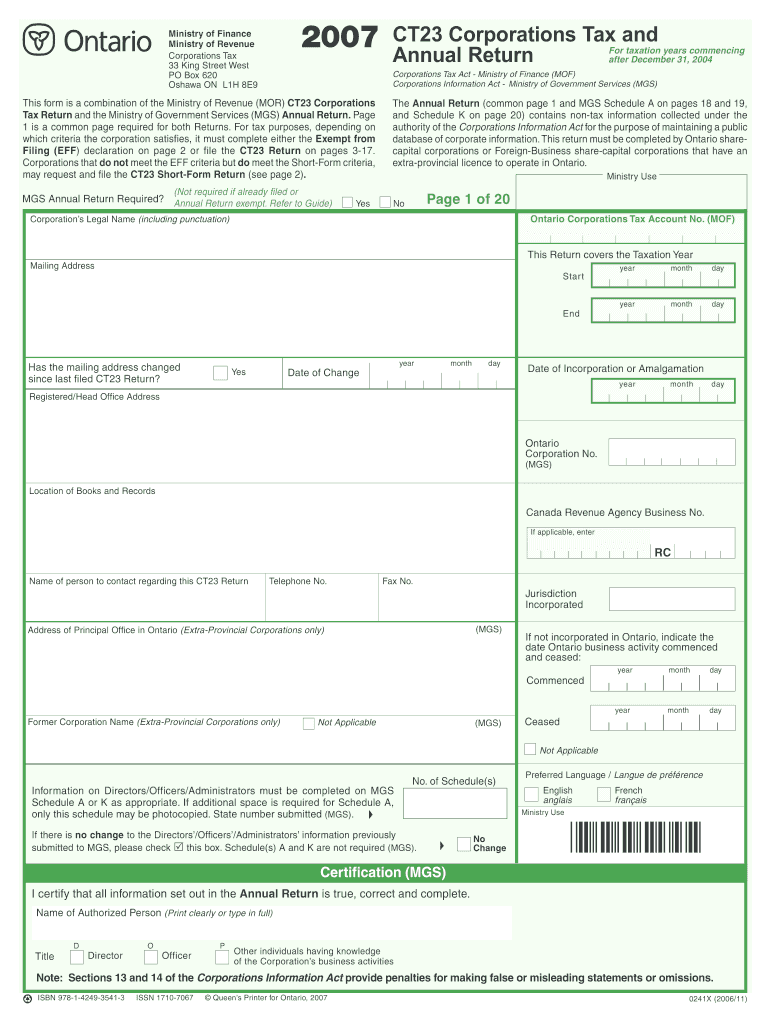

Canada CT23 2007-2024 free printable template

Show details

CT23 Page 3 of 20 Identification continued for CT23 filers only Please check applicable T box es and complete required information. Type of corporation Canadian-controlled Private CCPC all year Generally a private Canadian residents. 43. 4 Applies to employment of eligible students. CT23 Schedule 113 Attach Schedule 113 - Ontario Film Television Tax Credit OFTTC s. For tax purposes depending on which criteria the corporation satisfies it must complete either the Exempt from Filing EFF...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ct23 2007-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct23 2007-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct23 online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ct 23 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Canada CT23 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ct23 2007-2024 form

How to fill out ct23:

01

Gather all necessary information such as company details, financial statements, and supporting documents.

02

Complete the general information section by providing the company's name, address, contact information, and other relevant details.

03

Fill in the specific sections of the form based on the type of information required, such as income, expenses, assets, and liabilities.

04

Include any required attachments or supporting documents, ensuring they are properly labeled and organized.

05

Review the completed form for accuracy and completeness before submitting it.

Who needs ct23:

01

Businesses and companies that are required to file corporate income tax returns.

02

Companies that have a fiscal year-end date for tax purposes.

03

Organizations that are subject to corporate income tax regulations in their jurisdiction.

Video instructions and help with filling out and completing ct23

Instructions and Help about ct23 printable form

Fill canada ct23 return : Try Risk Free

People Also Ask about ct23

What is an 1120 tax form?

Is form 1120 for LLC?

What is the difference between 1040 and 1120?

How do I file an annual return for a corporation in Ontario?

Who must file a form 1120?

What tax form does C Corp file?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ct23?

There is no specific information or context provided about "ct23". It could refer to various things depending on the context. It would be helpful to provide more details or specify what domain or field it pertains to in order to provide a more accurate answer.

Who is required to file ct23?

CT23 is a corporate income tax return form used in Canada. It is required to be filed by Canadian resident corporations, including non-profit organizations, unless they are exempt from income tax.

The corporations that need to file CT23 include:

1. Canadian resident corporations that carry on an active business.

2. Non-profit organizations which are not exempt from income tax.

However, CT23 may not be required if the corporation:

1. Is a registered charity and files the T3010 Registered Charity Information Return.

2. Is a non-profit organization specifically exempt from income tax under a provision of the Income Tax Act.

3. Is an inactive corporation with no taxable income.

It is important for corporations to consult with a tax professional or the Canada Revenue Agency (CRA) to determine their specific filing requirements.

How to fill out ct23?

Form CT23, also known as the Corporations Information Act Return, is a form required by the Canadian government for corporations to report specific information about their business activities. Here is a step-by-step guide on how to fill out the CT23 form:

1. Company Information: Provide the legal name of your corporation, the mailing address, and the corporation number. If you have changed the legal name or address within the fiscal year, ensure that the previous information is also provided.

2. Legal Authority: Indicate whether your corporation is governed by federal or provincial legislation.

3. Accounting Period: Specify the start and end dates of the fiscal year of your corporation.

4. Financial Statements: Choose the type of financial statements you are submitting (audited, reviewed, or unaudited). If you are submitting audited or reviewed statements, provide the name of the auditing firm.

5. Relevant Information: Enter information about your corporation's primary business activities, such as the main industry code and the percentage of sales generated in Canada.

6. Directors and Officers: List the full names, mailing addresses, and SIN/BN of all the directors and officers of your corporation. Indicate their position or title within the corporation.

7. Contact Person: Provide the name and contact information for the person to contact regarding this return.

8. Certification: The return must be signed and dated by an authorized officer or director of the corporation, certifying that the information provided is true and complete.

9. Attachments: Attach any supporting documents that may be required, such as financial statements or schedules if applicable.

10. Filing and Payment: Submit the completed CT23 form and the applicable fee to the relevant government agency, such as the Canada Revenue Agency (CRA) or the respective provincial authority.

Note: Make sure to carefully read the instructions provided with the form to ensure accuracy and compliance with the reporting requirements of your jurisdiction. Seeking professional advice or consulting with an accountant or tax specialist may be beneficial to ensure the form is completed correctly.

What is the purpose of ct23?

CT23 is not a well-known term or acronym in a specific context. Without more context or information, it is not possible to determine its purpose or meaning. It could be a code, designation, or abbreviation specific to a certain subject or industry.

What information must be reported on ct23?

The CT23, also known as the Corporate Tax Return, is a form that businesses in Canada must file to report their income and taxes owed. The following information is typically required to be reported on the CT23:

1. Business Information: This includes the legal name, business number, and fiscal period of the corporation.

2. Income Statement: Corporations must report their revenue and deduct eligible expenses to calculate their net income or loss for the fiscal period.

3. Taxable Income Calculation: Corporations need to determine their taxable income by adjusting the net income with various deductions, such as capital cost allowance (CCA) and other allowable expenses.

4. Tax Calculation: Corporations must calculate the amount of federal and provincial taxes they owe based on their taxable income. This involves applying the applicable tax rates and determining any available tax credits or incentives.

5. Computation of Taxes Payable: Corporations must determine the total amount of taxes owed by adding up the federal and provincial taxes calculated earlier, less any overpayments or credits.

6. Instalment Calculation: If the corporation is required to make income tax instalment payments, they may need to determine the amount due for the next fiscal year.

7. Other Schedules: Different schedules may be required depending on the corporation's specific circumstances, such as foreign taxes paid, scientific research and experimental development (SR&ED) tax credits, and capital gains/losses.

8. Declaration and Signatures: The CT23 requires the corporation's authorized representative to sign the return to certify the accuracy of the information provided.

It's worth noting that the specific details and requirements for a CT23 can vary based on factors such as the corporation's size, type, and location. It is advisable to refer to Canada Revenue Agency (CRA) guidance or consult with a tax professional to ensure compliance with the latest filing requirements.

What is the penalty for the late filing of ct23?

The penalty for the late filing of CT23, which is the Canadian federal income tax return for corporations, can vary. As of the assistant's knowledge cutoff in 2021, the penalty is generally calculated as a percentage of the unpaid tax owing on the due date. It starts at 1% of the unpaid tax for each month the return is late, up to a maximum of 12 months. Additionally, there may be an additional penalty imposed if a corporation is a repeat late-filer. It is important to consult with a tax professional or refer to the most up-to-date information from the Canada Revenue Agency (CRA) for accurate penalty details.

Can I create an electronic signature for the ct23 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your ct 23 form and you'll be done in minutes.

How do I complete ct 23 form download on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your ct 23 forms form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit how to ct23 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute ct 23 form ontario from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your ct23 2007-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct 23 Form Download is not the form you're looking for?Search for another form here.

Keywords relevant to canada form corporations

Related to ct23 corporations printable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.