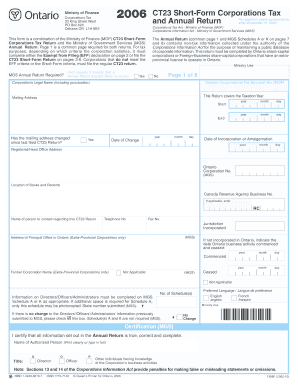

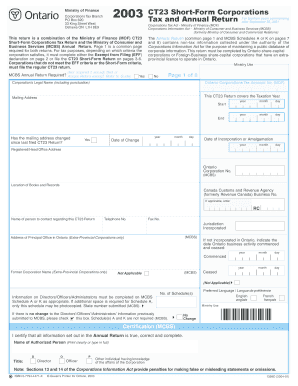

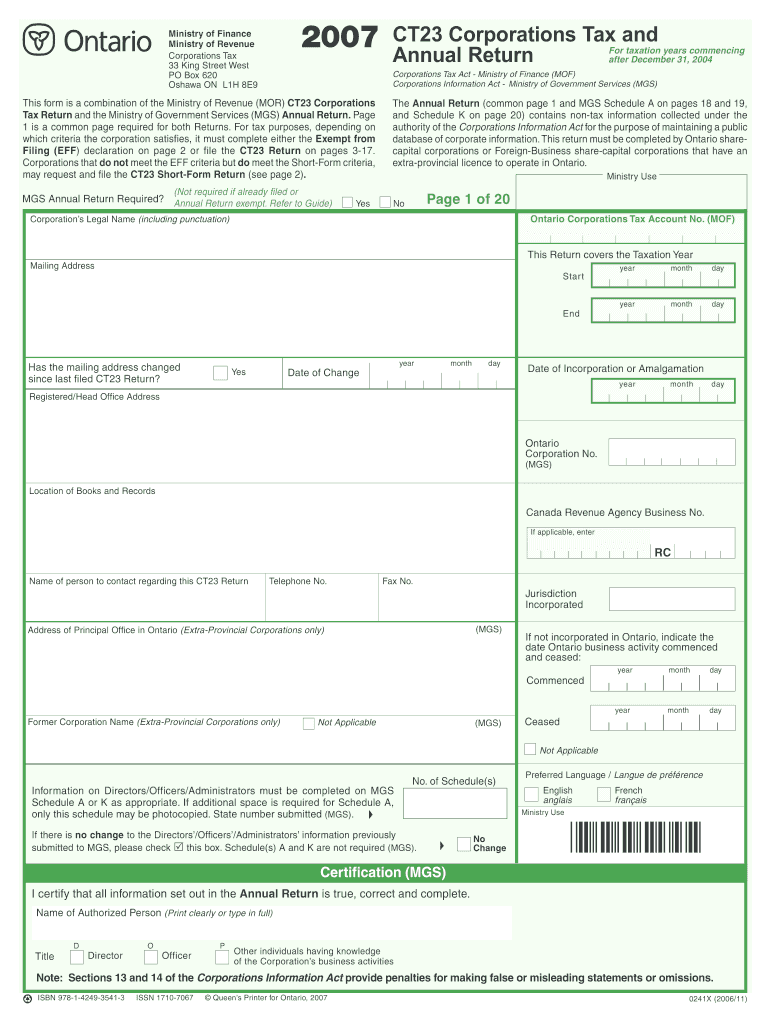

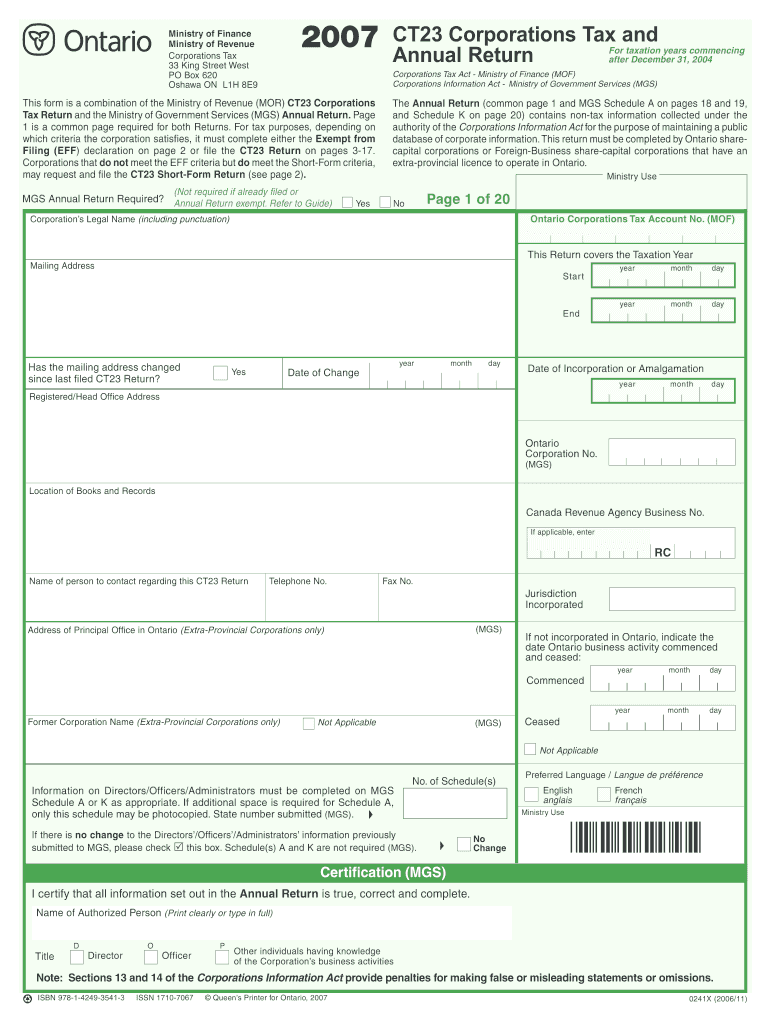

Canada CT23 2007-2026 free printable template

Show details

CT23 Page 3 of 20 Identification continued for CT23 filers only Please check applicable T box es and complete required information. Type of corporation Canadian-controlled Private CCPC all year Generally a private Canadian residents. 43. 4 Applies to employment of eligible students. CT23 Schedule 113 Attach Schedule 113 - Ontario Film Television Tax Credit OFTTC s. For tax purposes depending on which criteria the corporation satisfies it must complete either the Exempt from Filing EFF...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ct 23 form

Edit your ct23 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate tax returns form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct23 short form online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit corporate tax return canada form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada CT23 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax certificate ontario form

How to fill out Canada CT23

01

Gather all relevant financial documents, including income statements and expenses.

02

Download the Canada CT23 form from the Canada Revenue Agency (CRA) website.

03

Start with Part 1 by entering your business identification information (name, address, and business number).

04

Complete Part 2 by reporting your total income for the tax year.

05

Proceed to Part 3, where you will detail your eligible expenses.

06

Calculate net income by subtracting your total expenses from total income.

07

Fill in Part 4 for any deductions you are claiming.

08

Review the information to ensure accuracy.

09

Sign and date the form.

10

Submit the completed CT23 form to the CRA by the applicable deadline.

Who needs Canada CT23?

01

Small businesses operating in Canada that are required to file a corporate income tax return.

02

Corporations that earn income and need to report it to the Canada Revenue Agency.

Fill

ontario tax returns

: Try Risk Free

People Also Ask about corporate tax return

What is an 1120 tax form?

Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

Is form 1120 for LLC?

If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return. The 1120 is the C corporation income tax return, and there are no flow-through items to a 1040 or 1040-SR from a C corporation return.

What is the difference between 1040 and 1120?

If you are in business as a sole proprietorship, you report your income and expenses on a Schedule C attached to your federal Form 1040 tax return when it is filed. If you are a corporation or a partnership, you typically file a Form 1120 or a Form 1065 tax return.

How do I file an annual return for a corporation in Ontario?

Directly with the Ministry of Government and Consumer Services (Ministry) through ServiceOntario at our website .ontario.ca/businessregistry. There is no statutory fee. You must use a valid and up-to-date ServiceOntario online account to complete and file the Annual Return electronically with ServiceOntario.

Who must file a form 1120?

Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income. Domestic corporations must file Form 1120, unless they are required, or elect to file a special return.

What tax form does C Corp file?

A regular corporation (also known as a C corporation) is taxed as a separate entity. The corporation must file a Form 1120 each year to report its income and to claim its deductions and credits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ontario tax form in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your annual return ontario and you'll be done in minutes.

How do I complete form 23 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your ontario annual return, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit canada corporate tax return on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute eht annual return form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is Canada CT23?

Canada CT23 is a tax form used by corporations to file their corporate income tax return with the Canada Revenue Agency (CRA).

Who is required to file Canada CT23?

Corporations that operate in Canada and earn income or engage in business activities within the jurisdiction are required to file Canada CT23.

How to fill out Canada CT23?

To fill out Canada CT23, corporations must gather relevant financial information including income, expenses, and deductions. The form includes sections to report these details, and it must be completed accurately before submission to the CRA.

What is the purpose of Canada CT23?

The purpose of Canada CT23 is to provide the CRA with detailed information about a corporation's financial status, allowing for the assessment of corporate taxes owed.

What information must be reported on Canada CT23?

The information that must be reported on Canada CT23 includes the corporation's income, expenses, net income, tax credits, and other relevant financial data for the tax year.

Fill out your Canada CT23 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporation Tax Return Canada is not the form you're looking for?Search for another form here.

Keywords relevant to corporation tax template

Related to tax forms ontario

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.